Did you know that 22% of people skip taking their medication because they can't afford it? That's over 1 in 5 patients. But here's the good news: understanding your prescription cost before filling can prevent unexpected bills. In this guide, I'll walk you through exactly how to do it-no jargon, just clear steps you can use today.

Why Prescription Cost Discussions Matter

When patients skip doses due to cost, it's not just about money-it's about health. Studies show that 30% of people who face high medication costs skip doses or take less than prescribed. The Journal of General Internal Medicine found that patients who discuss costs with their providers are 37% less likely to skip doses. Yet only 15% of patients actually talk about costs during appointments. Why? Many don't know what to ask or when to ask it. The good news is that simple conversations can prevent these issues.

Before Your Appointment: Prepare Key Information

Don't wait until you're in the exam room to think about costs. Start early:

- Check your insurance formulary online. Most plans have a tool where you can search for your medication and see your out-of-pocket cost.

- Know your deductible status. If you haven't met your deductible this year, you'll pay more upfront. For example, individual marketplace plans average $480 deductible in 2023.

- Write down all current medications and their costs. This helps your provider spot cheaper alternatives.

Questions to Ask Your Provider

Bring these questions to your appointment:

- Is there a generic version of this drug? Generics often cost 85% less than brand names.

- What will my out-of-pocket cost be with my current insurance?

- Are there other medications on my formulary that might be cheaper?

- Can you prescribe a 90-day supply instead of 30 days? Many plans offer lower copays for larger quantities.

Understanding Insurance Tiers

Insurance plans group drugs into tiers with different costs. Here's how they typically work:

| Drug Tier | Cost (Copay or Coinsurance) |

|---|---|

| Tier 1: Generics | $5-$15 per fill |

| Tier 2: Preferred Brands | $25-$50 per fill |

| Tier 3: Non-Preferred Brands | $50-$100 per fill |

| Specialty Tier | 25-33% coinsurance (often $100+ per fill) |

This structure applies to both Medicare Part D and commercial plans, though exact amounts vary. For example, Medicare Part D plans must cover at least two drugs per category, while commercial plans can have up to six tiers. Knowing your drug's tier helps you ask the right questions.

Tools to Check Costs Before You Fill

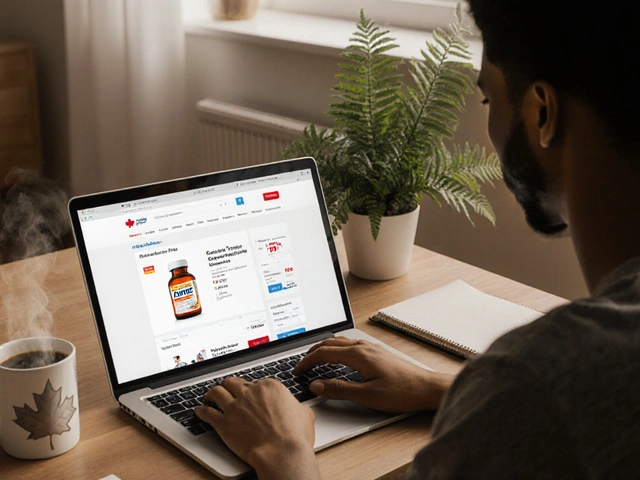

Several free tools help you see costs before you go to the pharmacy:

- GoodRx is a popular app that compares prices at local pharmacies and offers discount coupons. In 2023, users saved an average of $287 on blood pressure medications.

- Medicare Plan Finder (available on Medicare.gov) lets you compare drug costs across plans during open enrollment.

- Real-Time Prescription Benefit (RTPB) tools integrated into electronic health records let providers see your specific costs while writing prescriptions. Over 72% of EHR systems now include this feature.

What to Do If Costs Are Higher Than Expected

If your copay is higher than you expected:

- Ask your provider for prior authorization. This is a request to your insurance to cover a drug not on your formulary. Providers often submit these requests, and 68% of cases get approved.

- Check patient assistance programs. Pharmaceutical companies often have programs for low-income patients. For example, insulin assistance programs can reduce costs to $0 for qualifying individuals.

- Consider mail-order pharmacies. Many plans offer lower copays for 90-day supplies through mail-order services.

Recent Changes That Lower Costs

The Inflation Reduction Act of 2022 brought major changes starting in 2025. For Medicare beneficiaries:

- Out-of-pocket costs capped at $2,000 annually (down from $8,000 in 2024)

- Insulin costs limited to $35 per month

- Free vaccines for seniors

These changes are part of a broader push for transparency. CMS now requires all Part D plans to provide cost tools by 2024. For commercial insurance, the picture is more mixed-some states like California require public formulary access, but many plans still have complex tier structures.

Real Stories: How People Saved Money

On Reddit, a user named 'MedicareMom2023' shared how checking her plan's formulary before her appointment saved her $1,200 monthly on medication. She discovered her brand-name drug wasn't covered, so her doctor switched her to a generic alternative. Similarly, a GoodRx review from July 2023 stated, "I saved $287 on my blood pressure meds by showing the pharmacist GoodRx prices plus my insurance." These stories show that proactive steps work.

When to Call Your Insurance

Don't wait until you're at the pharmacy. Call your insurance company with the NDC number (found on your prescription label) to get exact costs. Average wait times are 14.7 minutes, but the information is worth it. For Medicare Part D, you can also use the Medicare.gov website to check your plan's specific coverage.

What if my drug isn't on my insurance formulary?

Your provider can request prior authorization from your insurance. This is a formal appeal asking the insurer to cover the drug. About 68% of these requests get approved. If denied, ask about alternative medications that are covered. You can also check patient assistance programs or use GoodRx for discounts.

How does the Medicare Prescription Payment Plan work?

Starting in 2025, Medicare Part D beneficiaries can pay for prescriptions through monthly installments instead of large out-of-pocket costs at the pharmacy. The plan caps annual out-of-pocket costs at $2,000. This helps spread costs throughout the year, making it easier to budget. Note: You must enroll before September to spread payments across the year.

Can I use GoodRx even if I have insurance?

Yes! GoodRx often shows lower prices than your insurance copay. Simply present the GoodRx coupon at the pharmacy. For example, a $100 prescription might cost $75 with insurance but only $50 with GoodRx. Always compare both options before paying.

Why do prescription costs vary so much between pharmacies?

Pharmacies negotiate different prices with drug manufacturers and insurers. For example, a pharmacy chain might get a better deal on a drug than an independent pharmacy. Using tools like GoodRx or Medicare Plan Finder helps you find the lowest price nearby. Always check multiple pharmacies before filling a prescription.

What's the difference between copay and coinsurance?

A copay is a fixed amount you pay per prescription (like $10 for generics). Coinsurance is a percentage of the total cost (like 20% of $100 = $20). Most insurance plans use copays for lower-tier drugs and coinsurance for specialty drugs. Knowing this helps you understand your out-of-pocket costs better.

Just used GoodRx and saved $150 on my prescription. So easy!

I've seen patients struggle with high costs. This article oversimplifies the real complexities.

Actually, the steps here are practical. I've used them and they work. No need to overcomplicate.

Prescription cost discussions are critical for medication adherence Studies show 37% less likely to skip doses when discussed Yet only 15% do Need to know formulary tiers Medicare Part D and commercial plans have different tiers For example Tier 1 generics cost $5-15 Specialty tier can be 25-33% coinsurance Always check your insurance before filling Many don't know what to ask This guide breaks it down well But more transparency is needed Pharmaceutical companies should be held accountable Ive had issues with prior authorizations Its a mess

In my country, we have different systems but the principles are similar. Always check with your provider.

The Inflation Reduction Act has made significant changes Medicare beneficiaries will see capped costs

Yes 🌟 The $2000 cap is a game changer also insulin at $35/month is huge 💉

OMG this is so unfair! Pharma companies are rippin us off! They're all in cahoots with the government. I'm so sick of this. #AmericaFirst

Exactly! Big Pharma controls everything. They're in cahoots with the government. Always check the source of your meds. It's all a scam.

Most people can't decipher insurance jargon. This guide is useless for them.

Actually its written clearly. I had no idea about tiers before. Thanks for the info!